SBI Annuity Deposit Calculator

Calculate your monthly/quarterly annuity income from SBI deposits

Principal Amount

₹1,00,000

Total Interest Earned

₹36,500

Monthly Annuity Payout

₹2,750

Total Payouts

₹1,36,500

Effective Yield

7.12%

Current SBI Annuity Deposit Rates

| Tenure | Interest Rate (p.a.) | Edit Rate (%) |

|---|---|---|

| 3 Years | 6.25% - 6.50% | |

| 5 Years | 6.50% - 6.75% | |

| 7 Years | 6.75% - 7.00% | |

| 10 Years | 7.00% - 7.25% |

* Rates are subject to change. Last updated: June 17, 2024

** Minimum deposit: ₹10,000. No premature withdrawal allowed.

How SBI Annuity Deposits Work

- Lump Sum Deposit: Invest a fixed amount (min ₹10,000) for 3-10 years.

- Regular Payouts: Receive monthly/quarterly interest payments.

- Principal Return: Get back principal at maturity.

- Taxation: Interest is taxable as per your income slab.

Benefits of SBI Annuity Deposits

- Guaranteed regular income (monthly/quarterly)

- Higher interest than savings accounts

- Safe investment (backed by SBI)

- Flexible tenure options

The SBI Annuity Deposit Scheme is a specialized deposit scheme designed for investors to receive monthly payouts and a regular income on the returns of the SBI Annuity Deposit Scheme. This scheme offers a fixed monthly income, making it an ideal choice for the people seeking regular payouts from their savings.

What is the SBI Annuity Deposit Scheme?

The SBI Annuity Deposit Scheme allows you to deposit a lump sum amount with the State Bank of India and receive fixed monthly payouts over a predetermined tenure. The monthly payouts include both the principal and interest, ensuring regular income for the depositor.

Key highlights of the scheme:

- Guaranteed Monthly Income: Offers fixed payouts over the tenure.

- Customizable Tenure: Choose between 36, 60, 84, or 120 months.

- Eligibility: Open to all individuals, including senior citizens who enjoy higher interest rates.

Why Use the SBI Annuity Deposit Scheme Calculator?

Calculating the monthly payouts and overall returns on the SBI Annuity Deposit Scheme can be complex. The SBI Annuity Deposit Scheme Calculator simplifies this process by providing accurate and instant results.

Benefits of the calculator:

- Estimate Monthly Payouts: Know the exact amount you’ll receive each month.

- Plan Investments: Compare different deposit amounts and tenures.

- Understand Interest Earnings: View the total interest earned over the deposit period.

- Senior Citizen Benefits: Factor in higher interest rates for senior citizens.

How to Use the SBI Annuity Deposit Scheme Calculator?

Using the SBI Annuity Deposit Scheme Calculator is simple and intuitive. Follow these steps:

- Enter Deposit Amount: Specify the lump sum you plan to invest.

- Select Tenure: Choose from available options—36, 60, 84, or 120 months.

- Select Interest Rate: Input the applicable rate based on your eligibility.

- View Results: Instantly see the monthly payout, total amount paid, and interest earned.

Key Features of the SBI Annuity Deposit Scheme Calculator

- Customizable Inputs: Adjust the deposit amount, tenure, and interest rate as needed.

- Accurate Calculations: Uses SBI’s latest interest rates for precise results.

- Detailed Outputs: Displays monthly payouts, total amount paid, and interest earnings.

- Responsive Design: Works seamlessly across all devices.

- Senior Citizen Benefits: Includes the higher interest rates applicable for senior citizens.

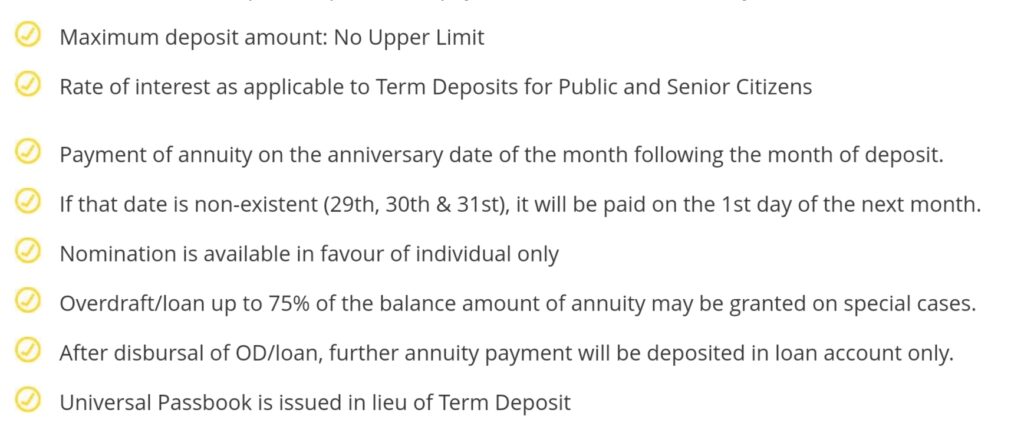

Key points of SBI Annuity Deposit Scheme Calculator

SBI Annuity Deposit Scheme Interest Rates (2025)

| Tenure | General Rate (%) | Senior Citizen Rate (%) |

|---|---|---|

| 36 months | 6.50% | 7.00% |

| 60 months | 6.75% | 7.25% |

| 84 months | 6.85% | 7.35% |

| 120 months | 6.90% | 7.40% |

Note: Rates are indicative and subject to change based on SBI’s policies.

Benefits of SBI Annuity Deposit Scheme Calculator

- Simple to Use: No financial expertise required—just input values and get results instantly.

- Informed Decisions: Plan your finances effectively by comparing different investment options.

- Error-Free: Eliminates manual calculation errors, ensuring accurate results every time.

- Time-Saving: Get instant results without complex formulas.

Breakdown on Monthly Payment You Receive From Bank

Let’s calculate the monthly payment you receive from this scheme, assume that the bank calculates that they will pay you ₹19,566 every month. The SBI Annuity Deposit Scheme Calculator will tell you the monthly payment you receive through this scheme. This payment is comprises of two parts:

- Principal Amount Repayment: This is a part of fund from your original fund invested (₹10,00,000).

- Interest Earned: The interest earned by you on the balance fund of your investment.

Details of Calculation, How the Scheme Works?

For example check for first month:

Original Investment Amount: ₹10,00,000/-

Interest earned: Assume the interest earned on the deposit for the first month is ₹5,417 (calculated using simple formulae (₹10,00,000 * 6.50% / 12).

Principal Repayment for first month: ₹19,566/- – ₹5,417/- = ₹14,149/-

Payment for first month:

Total payment you receive: ₹19,566/-

The part of principal amount returned: ₹14,149/-

Interest Earned: ₹5,417/-

Now check for second month:

Balance Principal Amount: ₹10,00,000/- – ₹14,149/- = ₹9,85,851

Interest earned: Assume the interest earned on the deposit for the second month is ₹5,340 (calculated using simple formulae (₹9,85,851 * 6.50% / 12).

Principal Repayment for second month: ₹19,566 – ₹5,340 = ₹14,226

Payment for Second month:

Total Payment to You: ₹19,566/-

The part of principal amount returned: ₹14,226 Interest Earned: ₹5,340

Remember this Process Repeats every month and your principal amount will reduce. The bank will pay you a fixed amount every month as per the calculation shown above.

Total amount you receive= 19566/-*60=11,73,960/-, Amount deposited by you=10,00,000/- and Total interest earned=1,73,960/-

Who Can Benefit from the SBI Annuity Deposit Scheme Calculator?

- Retirees: Plan for consistent monthly income to cover living expenses.

- Working Professionals: Save for future financial security.

- Financial Planners: Help clients make better investment decisions.

- Senior Citizens: Enjoy the advantage of higher interest rates.

Important Points on SBI Annuity Deposit Scheme Calculator

- SBI Annuity Deposit Scheme Calculator Online

- Monthly Income Calculator SBI

- SBI Fixed Annuity Deposit Calculator

- Annuity Scheme Interest Calculator SBI

- Calculate Monthly Payouts SBI

- SBI Annuity Deposit Scheme Benefits

- Annuity Deposit Interest Rates SBI

- SBI Investment Planning Tool

Doubts in Mind About the Calculator

1. What is the SBI Annuity Deposit Scheme Calculator?

It is an online tool that calculates the monthly payouts and overall returns for investments made under the SBI Annuity Deposit Scheme.

2. Is the calculator free to use?

Yes, the SBI Annuity Deposit Scheme Calculator is completely free and available online.

3. Can I use the calculator for senior citizen rates?

Absolutely! The tool includes options to calculate returns for senior citizens, factoring in the higher interest rates.

4. What tenure options are available for calculation?

The calculator supports all SBI Annuity Deposit Scheme tenures: 36, 60, 84, and 120 months.

5. Are the calculations accurate?

Yes, the calculator uses SBI’s latest interest rates to provide precise results.

Start Planning Your Financial Future Today!

The SBI Annuity Deposit Scheme Calculator is your ultimate partner in financial planning. Take control of your investments by knowing exactly how much you can earn from your lump sum deposits.

👉 Try the SBI Annuity Deposit Scheme Calculator Now!

| SBI Official page of this scheme | SBI Annuity Deposit Scheme |

Plan your finances smarter, enjoy regular monthly payouts, and secure your financial future with SBI’s trusted Annuity Deposit Scheme.